A sole proprietorship is a business that is owned, managed and controlled by one person. It is one of the most common forms of business in India, used by small businesses operating in the unorganized sectors. Proprietorships are very easy to start and have very minimal regulatory compliance requirement for getting started. However, after the startup phase, proprietorship's do not offer the promoter a host of other benefits such as limited liability, separate legal entity, independent existence, transferability, etc., which are desirable features for any business. Therefore, proprietorship's are suited for unorganized, small businesses that will have a limited existence.

Proprietorship Firm Registration in many way:

1. Registration under Labour Department in State.

2. One Person Company Registration under MCA Department ( Registered as Private Limited Company)

DOCUMENTS REQUIRED FOR PROPRIETORSHIP FIRM

INFORMATION REQUIRED FOR PROPRIETORSHIP FIRM

· Certificate of Registration.

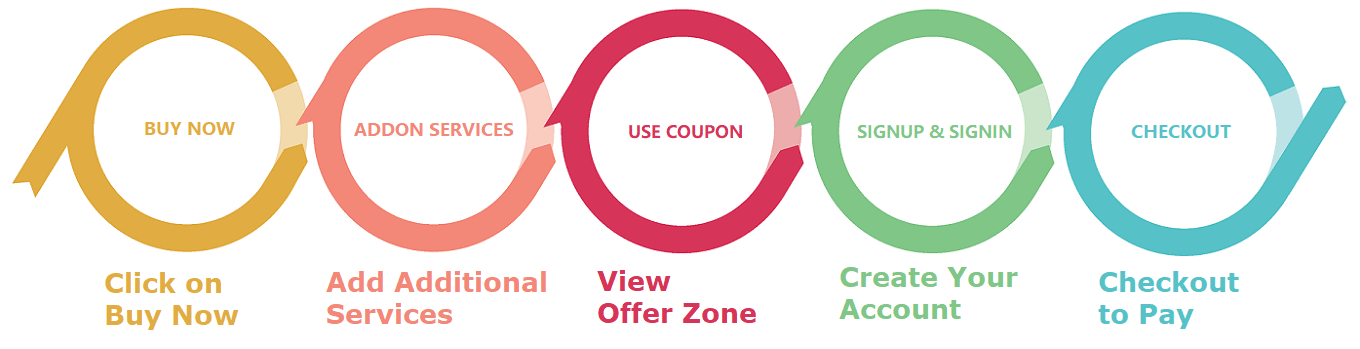

PROCESS

· Collection of Documents.

· Prepare of the documents.

· Filing of Registration Form with the Concerned Department.

· Assistance in Opening Bank account of Proprietorship Firm.

3-4 days after receipt of all the necessary Documents.

Ezzus India India

GST Registration Certificate and GST Number (its sufficient for start proprietorship firm)

Ezzus India India

GST Registration Certificate and GST Number + MSME Certificate

Ezzus India India

Fssai Registration (For Food Business) + Trademark Registration

Q1. What are the requirements to be a proprietorship?

Only one person is required to start a Proprietorship and a Proprietorship can have only one promoter.

Q2. What are the documents required to start a Proprietorship?

PAN Card for the Proprietor along with identity and address proof is sufficient to start a Proprietorship and obtain other registration, as applicable or required.

Q3. What is the capital required to start a proprietorship?

There is no limit on the minimum capital for starting a Proprietorship. Therefore, a Proprietorship can be started with any amount of minimum capital.

Q4. How to open a bank account for a proprietorship?

To open a bank account for a Proprietorship, Reserve Bank of India mandates that the proprietor provide two forms of registration for the Proprietorship along with the PAN Card, identity proof and address proof of the Proprietor. The two forms of registration can be any two of the following: service tax registration, MSME registration, VAT/TIN/CST registration, shop & establishment Act registration, Professional license, Chartered Accountant certificate or others as provided in the RBI Know Your Customer norms.

Q5. Will my proprietorship firm have a separate legal identity?

No, the Proprietorship firm and the Proprietor are one and the same. The PAN Card of the Proprietor will be the PAN Card of the Proprietorship business. Therefore, there will be no separate legal identity for the business. The assets and liabilities of the Proprietorship business and the Proprietor will also be one and the same.

Q6. Will my proprietorship firm have a certificate or incorporation or registration ?

Proprietorship firms do not have a Certificate of Incorporation or Certificate of Registration. The identity and legitimacy of a Proprietorship firm is established by registering with the relevant or applicable Government authorities.

Q7. How to register the name of proprietorship?

There is no registry or regulation for the registering the name of a Proprietorship. Therefore, proprietorship firms can adopt any name that do not infringe on registered trademarks. Since there are no registry or regulation for registering the name of a Proprietorship, the only way to ensure exclusive use of the business name is to obtain a trademark registration of the business name.

Q8. How can I transfer my proprietorship?

A business operated by proprietorship firm cannot be transferred to another person, unlike a Limited Liability Partnership or a Private Limited Company. Only the assets in the Proprietorship can be transferred to another person through sale. Intangible assets like Government approvals, registrations, etc., cannot be transferred to another person.

Q9. Can I have partners in a proprietorship?

Proprietorship firms are business entity that are owned, managed and controlled by one person. So Partners cannot be inducted into a Proprietorship firm.

Q10. Can other peoples invest in a proprietorship?

Proprietorship firms are business entity that are owned, managed and controlled by one person. So Proprietorship firms cannot issue shares or have investors

Q11. What are the annual compliances requirements for a proprietorship?

Proprietorship will have to file their annual tax return with the Income Tax Department. Other tax filings like service tax filing or VAT/CST filing may be necessary from time to time, based on the business activity performed. However, annual report or accounts need not be filed with the Ministry or Corporate Affairs, which is required for Limited Liability Partnerships and Companies.

Q12. Is Audit required for a proprietorship?

It is not necessary for Proprietorships to prepare audited financial statements each year. However, a tax audit may be necessary based on turnover and other criterion.

Q13. Can I later convert my proprietorship into a company or LLP?

Yes, there are procedures for converting your Proprietorship business into a Company or a LLP at a later date. However, the procedures to convert a proprietorship business into a Company or LLP are cumbersome, expensive and time-consuming. Therefore, it is wise for many entrepreneurs to consider and start a LLP or Company instead of a Proprietorship.