ELIGIBILITY/REQUIREMENT FOR NIDHI COMPANY:

Key Points:

1. It cannot carry any of the following kinds of transactions. Such as leasing finance, hire purchase finance, chit fund, insurance, or acquisition of securities issued by any corporation.

2. It cannot accept deposits from or give loans to some external individual or corporation.

3. A Nidhi Company is not empowered to issue preference shares, debentures, or some other debt instruments in any form.

4. Companies Act 2013 and Nidhi Rules 2014 are the governing bodies regulating the functions and operations of Nidhi Company in India.

5. Nidhi Company does not come under the purview of RBI. Therefore, Nidhi does not need any license from RBI to operate a loan business.

6. It is not entitled to perform vehicle finance business or microfinance business in India.

7. Within 12 months of registration, the number of members must be at least 200.

8. A maximum interest rate of 20% p.a. (calculated by the reducing balance method) can be charged.

9. The maximum rate of interest that can be offered on saving deposit account shall not exceed 2% above the rate offered by Nationalised Banks.

10. Nidhi Company can accept FD, RD & savings and can earn an interest of 12.5% currently.

11. Rate of Interest that can be offered on Fixed and Recurring Deposit shall not exceed the maximum rate of interest prescribed by RBI for the NBFCs to offer on their deposits. The maximum limit of the rate of interest for NBFCs is also applicable to the Nidhi companies.

12. Operations limited to district level for the first 3 Years. After completion of 3 years, 3 offices can be set up within the same district. For expansion out of the district, prior approval from the Regulator Director is required.

13. It can only give loans against security. These securities may be Gold, Property, Fixed Deposits, Government Securities or Life Insurance Certificates.

14. Unencumbered deposits (Deposits not offered as securities for any purpose) should not be less than 10 % of outstanding deposits.

15. Filing of Annual Accounts, Audit, and Tax Returns, in the proper format, is compulsory

INFORMATION REQUIRED FOR NIDHI COMPANY IN INDIA

Directors Detail:

1. Educational Qualification of all the Directors.

2. Profession/Occupation of all the directors with area of Operation

3. Citizenship alongwith Residential Status of all the Directors

4. Place of Birth of all the Directors

5. Permanent & Present Residential Status of all the Directors

6. Contact Numbers of all the Directors

7. Email Ids of all the Directors

Company Detail

Basic:

Once the Nidhi Company is incorporated it must fulfill the following requirements:

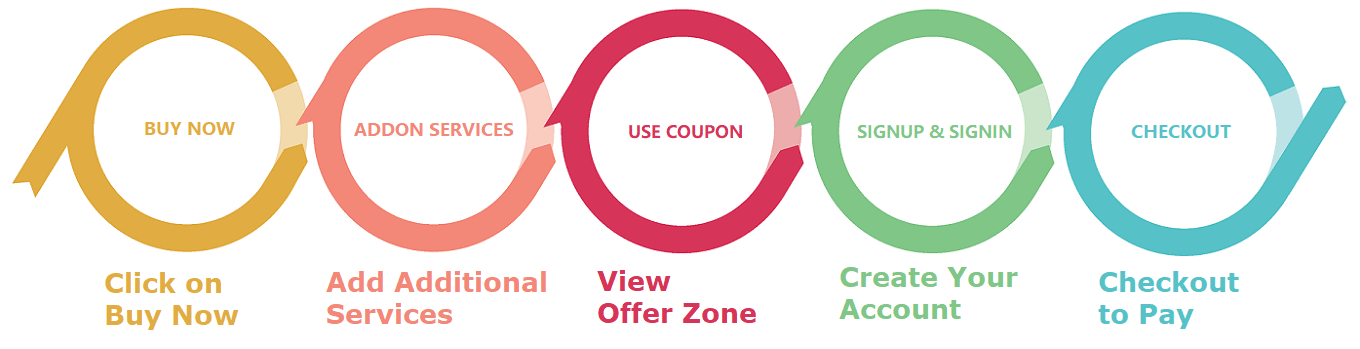

20-30 days

Ezzus India India

Nidhi Company Registration including 3 DIN + 7 DSC of Shareholders + Certificate of Incorporation + MoA/AoA + 1 Lakh Authorised Capital + PAN + TAN.

1. What is Nidhi company?

2. What are The Annual Mandatory Compliance for Nidhi Companies?

Nidhi Companies has to mandatory file some extra forms compared to other Private or Public Companies.

3. How is the registration of Nidhi Company different from the registration of other NBFCs?

Both of these entities are different at different levels. Nidhi is not regulated by RBI and Nidhi Company Registration requires a much smaller amount of capital than Rs. 2 Crore paid-up capital requirements for NBFCs.

4. What are Limitations or Restrictions on Nidhi Companies?

The following are some of the restrictions a Nidhi Company is subject to under Nidhi Rules, 2014. As per Rule 6 of Nidhi Rules, 2014, a Nidhi Company shall NOT:

5. Is there any limitation on the maximum number of members of the Nidhi Limited?

No, the Nidhi company can have as many members as possible. However, a minimum number of 200 members will be reached within the first financial year.

6. Can Nidhi Company indulge in any activity other than lending and borrowing?

Nidhi Companies are not authorized to conduct any business of any kind other than lending and borrowing on their own behalf.

7. Can a member who has previously defaulted on a loan from Nidhi be able to borrow from Nidhi again?

No. A member who has previously defaulted on a loan from Nidhi can not borrow from Nidhi again.

8. What kind of loans can not be issued by the Nidhi Company?

The following type of loans may not be granted to Nidhi Company:

1. Personal Loans

2. Financing of assets / vehicle

3. Microfinance

4. Rental-purchase

9. Can the Nidhi Company provide a microfinance business?

No, Nidhi Company is not allowed to conduct microfinance business in India. This is because microfinance is a completely different set of business for the NBFC and requires more capital to do the same. As a result, Nidhi Company can not engage in microfinance business. Furthermore, since Nidhi Company raises funds from deposits and therefore, if it passes the same to a member without any security, there will be a high risk of default on the customer, which will ultimately result in the Nidhi Company going bankrupt.

10.What is the maximum qualifying balance for interest calculation in the savings deposit account?

The maximum balance on the savings deposit account at any time eligible for interest shall not exceed one lakh rupee and the interest rate on such deposits shall not exceed two per cent above the interest rate payable on the savings bank account by the nationalized banks.

11. Is there any restriction on the opening of the Nidhi Company's branches?

Yes, yes. It can not open another branch until it has earned net profit after tax consecutively for three straight years after the successful registration of the Nidhi Company.

After three years of continuous business profit, the Nidhi Company can open up to three branches. Furthermore, these three branches can only be opened within the district. You will also require permission from the Regional Director (RD) to open any branch outside the district.

Nor can the Nidhi Company open a branch outside the state.

12. What is the maximum amount of deposits that Nidhi Company can take?

The Nidhi Company may take up a maximum of 20 times the net-owned fund. Net-owned fund means the total fund invested by the owner less any accumulated loss. For example, if you have invested Rs.1 crore, you are entitled to raise money to Rs.20 Crore.

13. Is Nidhi Company able to market its activities?

No, as per Nidhi companies are not authorized to promote their activities through any kind of advertisement This is because the main purpose of Nidhi is to promote the habit of drifting and saving habits among its members and not to solicit deposits through promotions to non-members.

Similarly, Nidhi Company is not authorized to remit any kind of brokerage or incentive for the promotion or mobilization of deposits to members or for the granting of loans.

14. How much loan can a Nidhi Company provide to its members?

For Nidhi Company loan limit is dependent upon the amount of deposits it holds. Following are specified limits:

|

Deposit amount (in Rupees) |

Loan Limit (in Rupees) |

|

Less than 2 Crore |

2,00,000 |

|

2 Crore-20Crore |

7,50,000 |

|

20 Crore-50Crore |

12,00,000 |

|

More than 50 Crore |

15,00,000 |

15. What do you mean by the Mutual Benefit Company and how it differs from the Nidhi Company?

Mutual Benefit Company is nothing but the Nidhi Company. The mutual benefit is the previous name of the company Nidhi. After 2013, it was made compulsory to use the name of Nidhi Limited instead of the Mutual Benefit for registration of Nidhi Company in India.

16. Who could become a member of the Nidhi Company?

In order to become a member of the Nidhi company, the following requirements must be met:

1. Member must be an individual, and no corporate body or trust can become a member.

2. The member must have reached the age of 18 years.