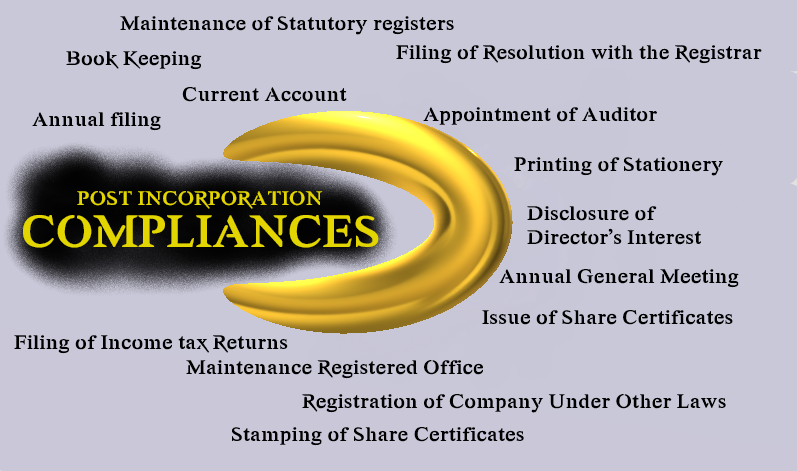

Post Incorporation Compliances

When you read this article, your company registraion certificate already in your hand.

Your new private company is now registered with MCA and Now it is a separate legal entity which is distinct from directors and members of the Company. The private limited company registration gives you many benefits which you can never avail without a corporate structure like

- addition/deletion of Competent persons on the board

- attract the best talent with equity/ can add shareholders,

- Raise loans easily on Companies name without personal liability of directors.

But it’s no free lunch. To prove you’re worthy of these advantages, you need to comply with the rules and regulations of the Companies Act, 2013, starting from the day you incorporation.

We are hereby providing you the comprehensive guide for all compliances required to be completed after incorporation.

Opening of Current Bank Account after company formation under MCA.

One of the first orders after incorporation is to contact with the banker of your choice for opening Current bank account of the company. As you must be aware that PAN & TAN are also issued by the Registrar at the time of incorporation itself. You just have to contact to the banker for accountand need to submit docs:

- COI of the Company

- MOA & AOA (Form 32 & 34)

- Copy of Pan Card

- Copy of Board Resolution for opening account & authorization to directors.

- Self attested copies of Directors id and address proofs

- Copy of utility bill alongwith Rent agreement if rented premises.

- Other docs as may be required depends upon the banker.

- Appointment of Auditor [Section- 139(6)]

After getting COI the next course of action in terms of compliance is the appointment of the first auditor of the company. Within 30 days from the date of registration of the company, the Board of Directors must call a board meeting and appoint an auditor for the company. In case the Board fails to appoint an auditor within the above timeline, it is required to inform the members of the company, who may then within 90 days of such intimation, appoint the first auditor of the company at an Extraordinary General Meeting. The tenure of the auditor so appointed is to be till the conclusion of the first Annual General Meeting. And to file the Form ADT-1 to the Registrar of Companies within 15 days of Appointment.

- Disclosure of Director’s Interest and Declaration Regarding Disqualification [Section 184(1)]

Every director shall at the first board meeting in which he participates as a director and thereafter at the first board meeting in every financial year or whenever there is any change in the disclosures already made, then at the first Board meeting held after such change, disclose his concern or interest in any company or companies or bodies corporate, firms, or other association of individuals which shall include the shareholding in form MBP-1 and also a declaration in Form DIR-8 that he/she is not disqualified to become/continue director of the Company both of which shall be kept at the registered office of the Company.

Such forms shall be preserved for a period of eight years from the end of the financial year to which it relates and shall be kept in the custody of the any other person authorized by the Board for the purpose.

- Maintenance Registered Office [Section -12(1)] and [ Section-12 (3)(a)]

On and from the 15th day of its incorporation and at all times thereafter, the company is required to have a registered office capable of receiving and acknowledging communication and notices. If the Company has not mentioned the Details of Registered office at the time of Incorporation and just mentioned the address for Correspondence. The company is required to file a verification of the registered office with the Registrar of Companies within a period of 30 days of its incorporation in form INC-22.

Furthermore, every company must:

- paint or affix its name, and the address of its registered office, and keep the same painted or affixed, on the outside of every office or place in which its business is carried on, in a conspicuous position and in legible letters. This board must be in one of the languages in general use in that locality;

- get its name, address of its registered office and the Corporate Identity Number (CIN), along with telephone number, fax number, if any, e-mail and website addresses, if any, printed in all its business letters, billheads, letter papers and in all its notices and other official publications; and

In case of any default in complying with any of these requirements in respect of the registered office etc., a company and every officer who is in default shall be subjected to a penalty of Rs. 1,000 for every day during which the default continues, not exceeding Rs. 1,00,000.

- Issue of Share Certificates to First Subscribers [Section- 56(4)(a)]

Within a period of 2 months from the date of incorporation, every company must deliver the share certificates to the first subscribers of the memorandum. This also means that the subscriber has to remit/transfer the agreed subscription amount within 60 days from the date of incorporation in the Company’s account itself through bank channel only.

Failure by the company to deliver the certificates will attract a fine which shall not be less than Rs. 25,000 but which may extend to Rs. 5,00,000. Also, every officer of the company who is in default shall be punishable with a fine which is not less than Rs. 10,000 but which may extend to Rs. 100,000.

- Printing of Stationery and related Compliances

There are logistical compliances, too, that companies are required to fulfill immediately after incorporation. These include:

- printing of Letterhead & Statutory Registers

- Mandatory particulars on the letterhead i.e. company identification number (CIN), registered office address, email ID of the company, website address, if any, and telephone number.

- Adopt rubber stamps. Prepare two rubber stamps. One round stamp in the name of company and second one in the name of the director.

- A printed set of Memorandum of Association and Articles of Association (optional)

- Registration of Company Under Other Laws And As Per Business Activity

The Company incorporation does not mean that you have been registered in all laws and only means that a separate legal entity has been created by the law and now according to its business it has to be registered under other laws applicable to it like:

- Registration under GST in case of manufacturer/trader/service provider etc

- Taking of IEC Code in case of Importer/exporter

- Applying for FSSAI license in case of Food Business

- Applyying for Trademark/brand name registration for getting exclusive right on your brand

- Applying for ESI/PF Registrations as per applicability.

- Taking of ISO Certificate (Optional)

- Applying for Bar code (Optional)

- Applying for BIS Mark (Optional)

- Applying for Agmark registration(Optional)

- Applying for Drug License in case of dealing in drug (Optional)

- Applying for MSME Registration (Optional)

- Applying for Weight & Measurement License/Legal Methology in case of packaging business

- Other Registrations as and when required

Also Note that after registration in other laws also need to comply returns formalities under other laws as may be applicable.

- Filing of Resolution with the Registrar in form MGT 14

There must be an intimation to the RoC for certain resolutions passed at any meeting between directors or members of the company through form MGT 14. Such filings should be made within 30 days of passing; else a penalty is leviable.

- Stamping of Share Certificates [Section 3 of Indian stamp act]

Stamping of share certificates means whenever a company issues any share certificate it has to be stamped which is to be paid within 30 days of issuance of share certificates. Stamping means payment of stamp duty on the value of share certificates issued. Share certificate shall be issued

- Within 2 months of incorporation to the subscribers of MOA

- Within 2 months of Allotment of Fresh sharesto the allottes

- Within 1 months of receipt of transfer/transmission of shares

The Share Certificates issued must be signed by 2 directors and the applicable stamp duty must be paid to make them enforeceable. The stamp duty in delhi is 0.1% of the consideration (face value + premium if any) This is online which require a need of professionals.

In Case of non payment, the company shall be liable for heavy penalty which may extend to 10 times of duty

- Maintain copies of Incorporation Documents [Section 7(4)]

The company shall maintain and preserve at its registered office copies of all documents and information as originally filed on incorporation till the dissolution of the Company.

- No. of Board Meeting [Section 173 and SS-1]

A Company shall hold its

- firstBoard meeting within thirty days of the date of its incorporation, and

- Thereafter hold a minimum number of four Board meetings every year in such a manner that not more than one hundred and twenty daysshall intervene between two consecutive meetings of the Board.

- Prepare Minutes Books. [Section-118(1) ]

Every Company shall prepare minutes of every meeting with in 30 (Thirty) days of the conclusion of every such meeting.

- Maintenance of Statutory registers

A company has to maintain certain registers as prescribed under the Companies Act like Register of Members, Register of Directors, Register of debenture holders/ other Securities holders, Register of Charges, Register of Share Transfer, Register of Contracts with Related parties etc.

- Annual General Meeting

A company should hold its first AGM within a period of 9 months from the date of closing of the first financial year of the company and in any other case, within a period of 6 months, from the date of closing of the financial year and not more than 15 months shall elapse between the date of one annual general meeting of a company and that of the next.

- Filing of Income tax Returns with the ITD

A Company is in mandatory step to get its accounts audit even if it is in loss or has not started business. Company has prepare its Balance Sheet and Statement of Profit and Loss and get it audited by the Chartered accountant to whom they have appointed and file the copy of the same with the Incme tax department.

- Getting Accounts audit Annual filing of same with the Registrar

A Company has to file form AOC-4 for Balance Sheet and Statement of Profit and Loss within 30 days from the date of Annual General Meeting and form MGT-7 for Annual Return within 60 days from the date Annual General Meeting.

- Book Keeping of the Company

Accounting is not just a basic need but also a statutory requirement under Companies Act and Income Tax Act for the company. As an entrepreneur, you should have control over your accounts. It will not only give you a true view over your business, but will also help you to take the necessary steps required any given point in time.

Bookkeeping is one of the many post incorporation compliances that are to be followed by almost all companies.

Bookkeeping:

- All entrepreneurs generally keep a record of their financial transactions either in an excel form or a note book. Just recording your transactions in a suitable manner won’t fulfill the purpose of bookkeeping.

- Keeping the transaction in a prescribed format will only makes it acceptable as a statutory compliance.

- Bookkeeping involves maintaining a regular record of transaction in such a way that results can be extracted in various forms as desired.

- As you start growing, the first thing that make you more uncomfortable is your accounts, if you are maintaining it yourself. However, if the same activity is carried out by a professional, this exercise may yield fruitful results.

Benefits of Bookkeeping

- Saves your penalty or interest on taxes

- Preparation of Statement of sale/purchase/services taken or given.

- Easily stock verification

- A free insight on income/expenses

- A free sight on debtors/creditors

- A free sight on biling of the company

- Alertness on other registration required after certain turnover or sales.

- A quick view on TDS transactions

- Easy calculations of TAX Liability

- Easy preparation of monthly returns

- Easy preparation of balance sheet and profit & loss.

- It will be easy for auditors to conduct audits.

- Signing of Retainership Agreement with Corporate professional

Only professionals can assist you in many complex matters and the company needs advice on many complex matters which require expert opinion, such as for example Company compliances, FEMA, Labor Laws, Income tax matters, Matters or Landed / Intellectual Property issues etc.

19 And the last but ot the least is Internal Control

Apart from statutory needs the company also need to take various internal decisions like:

- Business planning & Decisions.

- Risk factor

- Social impacts

- Budget monitoring

- Tax planning

- Investment

- Loan factor

- Marketing strategies

- Current trend

- Competitors

- Research

- Market durability

- Product/service Uniqueness from competitors

- Vision, mission

- Opportunities and threats

- Setting Targets

- Streaming time line etc

- Partners/associates capability

We Ezzus India introduce ourselves as a niche team of professionals providing wide range of Services related to the above compliances and serving companies and assisting corporates to comply with the applicable provisions applicable on them. since from incorporation, management of companies till their closures.

If you have any clarifications or questions on the above article, drop us a mail or contact us and we will be happy to assist you.

Call : 9717712008

Comment here